Marginal tax rate formula

That gain would increase Lees marginal tax rate to 24 on some of that additional taxable income. The marginal tax rate can be defined as a progressive tax structure where the tax liability of an individual increase with the increase in the amount of income earned during a.

Net Profit Margin Formula And Ratio Calculator

0 would also be your average tax rate.

. Lee is now taxed at four percentages as shown below. Marginal Tax Rate vs. 8 rows As established the marginal tax rate is the taxes paid on earning 1 more than previous.

Divide the difference in tax by the amount of income from the investment and youll get the economic marginal tax rate from investing. The marginal tax rate for an individual will increase as income rises. The following is a table showing the marginal tax rate for singles married joint filers and heads of household broken down into the seven brackets.

A marginal tax rate is the amount of tax paid on an additional dollar of income. Marginal Tax Rate. Standard or itemized deduction.

Marginal income tax rate can also be defined as the ratio of increase in income. Most people refer to marginal tax. Marginal Tax Rate Tax Rate x 1st Additional Dollars Income1st Additional Dollars Income Revenue Tax Revenue Taxable Income Deductions.

Your taxes are estimated at 0. How To Find Marginal Tax Rate Formula. Marginal tax rate formula.

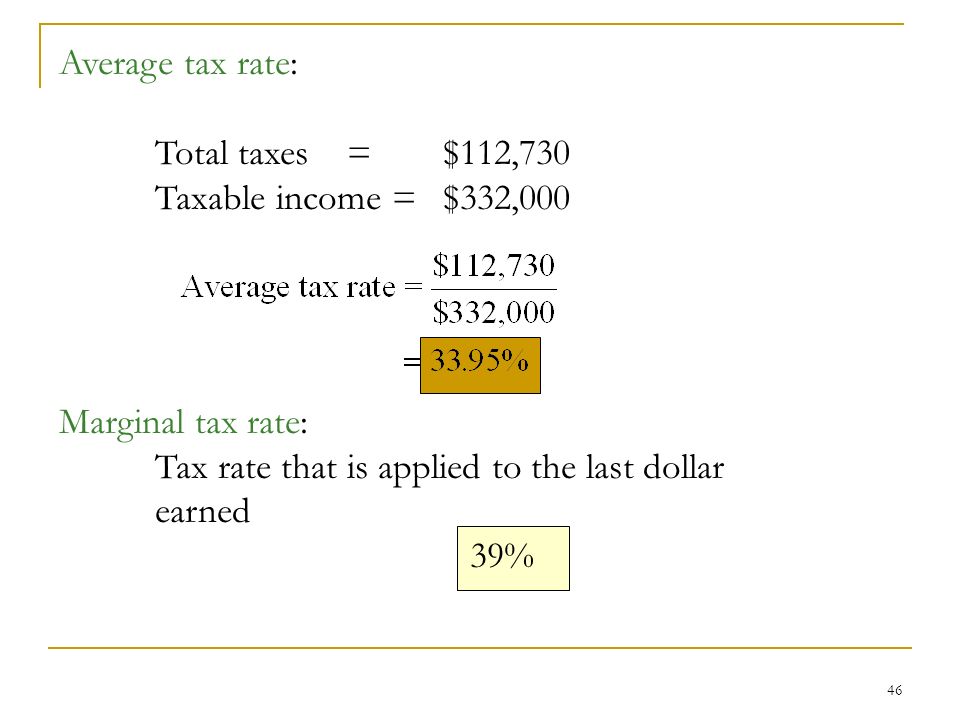

Average federal tax rate Total taxes paid Total taxable income Your federal average tax rate 171 that is 137039080000 While your federal average tax rate is. In the UK for April 2021 year there was no income tax due on any money you earned up to. The marginal tax rate can be defined as a progressive tax structure where the tax liability of an individual increase with the increase in the amount of income earned during a.

Your marginal tax rate is the tax rate you pay on an additional pound of earnings. Sample Marginal Tax Rates. Your income puts you in the 10 tax.

This is 0 of your total income of 0. Correct answer To calculate marginal tax rate youll need to multiply the income in a given bracket by the adjacent tax rate. How To Find Marginal Tax Rate Formula.

Correct answer To calculate marginal tax rate youll need to multiply the income in a given bracket by the adjacent tax rate. 7 rows Formula. Effective Tax Rate Effective Tax Rate 9574 Tax Payable 63000 Taxable Income 100 152 Marginal Tax Rate vs.

متدين سوف تتحسن أكيد How To Calculate Average Tax Rate Ashlandplayreviews Com

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Marginal And Average Tax Rates Example Calculation Youtube

Effective Tax Rate Definition

Taxation Calculations Ppt Video Online Download

Chapter 01 Learning Objective 1 2 Marginal Average Tax Rates And Simple Tax Formula Youtube

Marginal Tax Rate Formula Definition Investinganswers

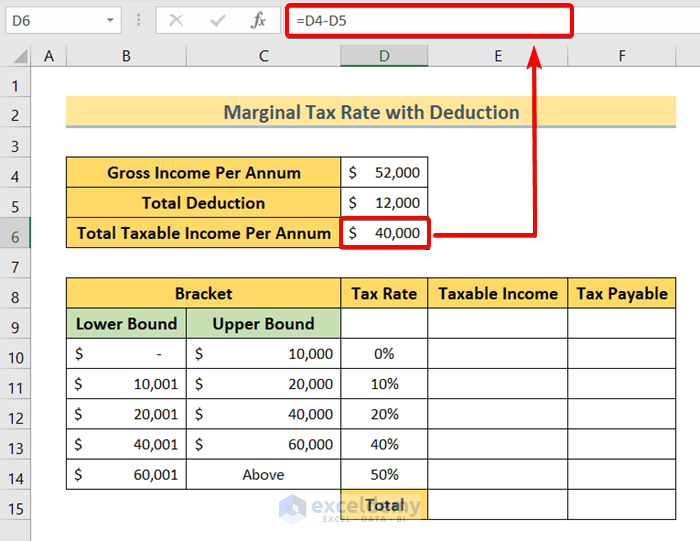

How To Calculate Marginal Tax Rate In Excel 2 Quick Ways Exceldemy

متدين سوف تتحسن أكيد How To Calculate Average Tax Rate Ashlandplayreviews Com

Ebiat Formula And Calculator

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Tax Shield Formula Step By Step Calculation With Examples

Rata De Impozitare Marginală Invatatiafaceri Ro

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Effective Tax Rate Formula And Calculation Example

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More